What to Know Before Choosing a Medicare Advantage Plan: A Comprehensive Guide

Delve into the world of Medicare Advantage plans with a focus on vital considerations before making your selection. From coverage options to financial implications, this guide offers a roadmap for navigating this complex healthcare landscape.

Explore the nuances of Medicare Advantage versus Original Medicare and uncover the key factors that can shape your decision-making process.

Factors to Consider

When choosing a Medicare Advantage plan, there are several key factors to consider to ensure you select the right option for your healthcare needs. It is essential to understand the differences between Medicare Advantage and Original Medicare, as well as evaluate coverage options and costs.

Differences Between Medicare Advantage and Original Medicare

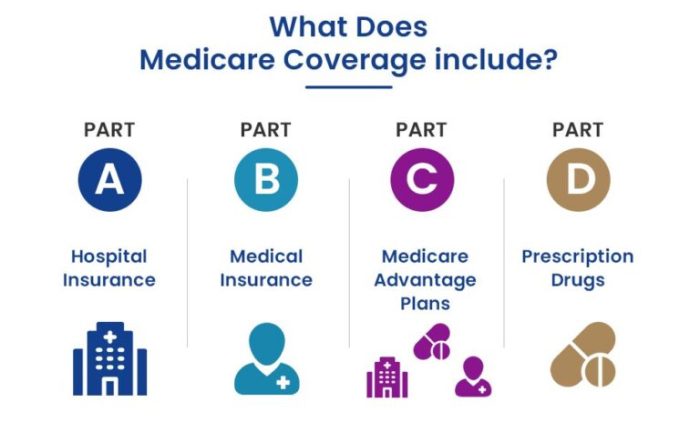

Medicare Advantage plans, also known as Medicare Part C, are offered by private insurance companies approved by Medicare. These plans provide all the benefits of Original Medicare (Part A and Part B) and often include additional benefits such as vision, dental, and prescription drug coverage.

On the other hand, Original Medicare is the traditional fee-for-service program run by the federal government.

Importance of Evaluating Coverage Options and Costs

It is crucial to carefully review the coverage options and costs of each Medicare Advantage plan before making a decision. Consider factors such as monthly premiums, annual deductibles, copayments, coinsurance, network restrictions, and out-of-pocket maximums. Evaluate whether the plan covers the healthcare services and providers you need, including prescription medications, specialists, and hospitals.

Network Coverage

When selecting a Medicare Advantage plan, one crucial factor to consider is the network coverage offered by the plan. Network coverage dictates which healthcare providers or facilities you can visit to receive covered services.

Differences Between HMO and PPO Networks

- HMO (Health Maintenance Organization): HMO plans typically require you to choose a primary care physician (PCP) and get referrals from your PCP to see specialists. You must generally receive care from providers within the plan's network to be covered for services.

- PPO (Preferred Provider Organization): PPO plans offer more flexibility in choosing healthcare providers. You can see any doctor or specialist, whether they are in-network or out-of-network, but you will pay less out-of-pocket if you stay in-network.

Impact of Network Restrictions on Care Choices

- Network restrictions can limit your choice of healthcare providers, potentially leading to longer wait times for appointments or having to travel further for care.

- If you choose an HMO plan and need to see a specialist outside of your network without a referral, you may have to cover the entire cost of the visit yourself.

- On the other hand, with a PPO plan, you have the flexibility to see specialists without referrals, but you may pay higher out-of-pocket costs if they are out-of-network.

Prescription Drug Coverage

When choosing a Medicare Advantage plan, it is crucial to carefully review the prescription drug coverage offered. Many plans include this benefit, but the specifics can vary widely, affecting your out-of-pocket costs for medications.

Comparing Formularies and Understanding Medication Costs

To ensure you select the most cost-effective plan for your prescription needs, it is essential to compare formularies. Formularies are lists of covered medications and their associated costs. By reviewing these lists, you can determine which plan offers the best coverage for the medications you require.

Additionally, understanding medication costs under each plan will help you budget for your healthcare expenses more accurately.

- Compare the co-pays or co-insurance amounts for your medications across different plans.

- Look into any restrictions or prior authorization requirements for specific drugs.

- Consider if mail-order options are available for maintenance medications, which can often be more cost-effective.

Ensuring Necessary Medications are Covered

When evaluating Medicare Advantage plans, it is crucial to confirm that your necessary medications are covered. Failure to do so could result in unexpected expenses or interruptions in your treatment plan. Here are some steps to take to ensure your medications are included in the plan's formulary:

- Check if your current prescriptions are on the plan's list of covered medications.

- Discuss with your healthcare provider if there are suitable alternative medications that are covered by the plan.

- Consider requesting a formulary exception if your medication is not listed but is medically necessary for your condition.

Additional Benefits

When choosing a Medicare Advantage plan, it's essential to consider the extra benefits offered beyond basic healthcare coverage. These additional benefits can have a significant impact on both your healthcare costs and overall quality of life.

Dental, Vision, and Hearing Coverage

Many Medicare Advantage plans offer coverage for dental, vision, and hearing services, which are not typically included in Original Medicare. This can help you save money on routine dental cleanings, eye exams, prescription glasses, hearing aids, and other services related to these areas of healthcare.

- Some plans may provide preventive dental care at no extra cost, while others may offer more comprehensive coverage for procedures like fillings, crowns, or dentures.

- Vision benefits can include coverage for eyeglasses or contact lenses, as well as discounts on LASIK surgery.

- Hearing benefits may cover the cost of hearing exams, hearing aids, and other hearing-related services.

Fitness Programs and Wellness Benefits

In addition to traditional healthcare services, some Medicare Advantage plans also offer fitness programs and wellness benefits to help you stay healthy and active. These programs may include gym memberships, fitness classes, nutrition counseling, and other resources to support your overall well-being.

- Participating in fitness programs can help you maintain a healthy lifestyle, manage chronic conditions, and prevent future health issues.

- Wellness benefits may also include access to telehealth services, mental health resources, and support for managing stress or anxiety.

Financial Considerations

When choosing a Medicare Advantage plan, it's crucial to consider the financial aspects to ensure you're getting the best value for your healthcare needs. Evaluating out-of-pocket costs, premiums, and deductibles can help you make an informed decision.:Medicare Advantage plans often come with different cost structures compared to Original Medicare.

While some plans may have lower monthly premiums, they might have higher out-of-pocket costs or deductibles. On the other hand, plans with higher premiums may offer lower out-of-pocket expenses. It's essential to weigh these factors based on your healthcare usage to determine which plan would be more cost-effective for you.

Evaluating Out-of-Pocket Costs, Premiums, and Deductibles

- Out-of-Pocket Costs: Consider copayments, coinsurance, and any other expenses you might need to pay when receiving healthcare services.

- Premiums: Compare the monthly premiums of different plans to see how they fit into your budget.

- Deductibles: Determine the amount you'll need to pay out of pocket before your plan begins covering costs.

Doctor and Hospital Choices

When choosing a Medicare Advantage plan, it is crucial to ensure that your preferred doctors and hospitals are within the plan's network. This ensures that you can continue receiving care from the healthcare providers you trust.

Verifying Provider Acceptance and Accessibility

- Check the plan's provider directory: Review the list of in-network doctors and hospitals provided by the Medicare Advantage plan. Make sure your current healthcare providers are included.

- Contact providers directly: Reach out to your doctors and hospitals to confirm if they accept the specific Medicare Advantage plan you are considering.

- Consider travel distance: Evaluate the location of in-network providers to ensure they are accessible to you, especially in case of emergencies or regular appointments.

Ensuring Continuity of Care

- Discuss with your current providers: Inform your current doctors about your intention to switch to a Medicare Advantage plan. They may provide guidance on selecting a plan that allows you to maintain continuity of care.

- Transition of medical records: Ensure a smooth transition of your medical records from your previous insurance to the new Medicare Advantage plan to avoid any disruptions in your healthcare.

- Understand referral requirements: Some Medicare Advantage plans may require referrals to see specialists. Make sure you are aware of these requirements to avoid any obstacles in accessing healthcare services.

Closure

In conclusion, understanding the intricacies of Medicare Advantage plans is essential for making informed choices about your healthcare. By weighing factors like network coverage, prescription drug benefits, and financial considerations, you can pave the way for a healthier and more secure future.

Q&A

What should I prioritize when choosing a Medicare Advantage plan?

It's crucial to consider factors like network coverage, prescription drug benefits, additional perks, financial implications, and doctor/hospital choices.

How do I know if my preferred doctors and hospitals are in-network?

You can verify this by checking with the plan provider directly or using their online tools to search for specific healthcare providers.

Are there any hidden costs I should be aware of with Medicare Advantage plans?

It's important to review the out-of-pocket costs, premiums, deductibles, and any potential co-pays or coinsurance associated with the plan.