Embarking on the journey of Affordable Health Insurance for Small Companies in 2025, this introduction aims to provide a comprehensive look at the obstacles faced by small businesses and the innovative solutions that can make health insurance more accessible.

The evolving landscape of health insurance and its impact on small companies will be explored, shedding light on the future of affordable healthcare benefits.

Challenges faced by small companies in providing affordable health insurance

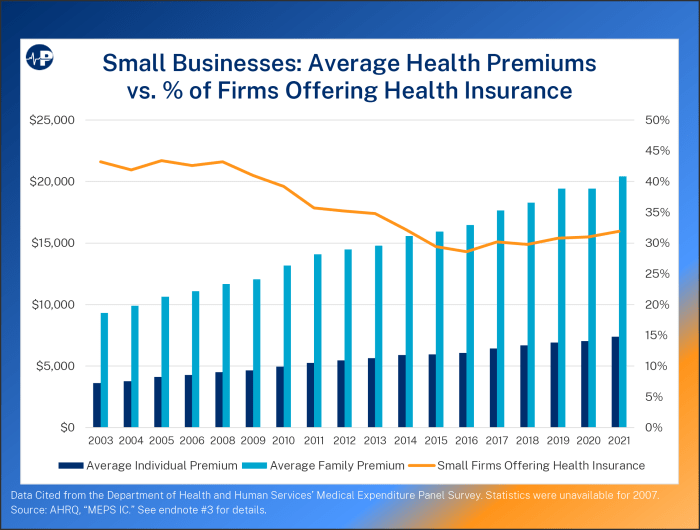

Small companies often struggle to provide affordable health insurance to their employees due to various obstacles they face in the current landscape. The key factors contributing to the difficulty of accessing affordable health insurance for small businesses include limited bargaining power, higher administrative costs, and lack of economies of scale compared to larger corporations.

Limited bargaining power

Small companies have fewer employees, which translates to lesser bargaining power when negotiating with insurance providers. This results in higher premiums and limited coverage options, making it challenging for small businesses to offer comprehensive health insurance benefits to their employees.

Higher administrative costs

Small companies typically have limited resources and manpower to handle the administrative tasks associated with providing health insurance. This includes managing enrollment, claims processing, and compliance with regulatory requirements. These higher administrative costs can further strain the financial resources of small businesses, making it harder to offer affordable health insurance.

Lack of economies of scale

Unlike larger corporations, small companies do not benefit from economies of scale when purchasing health insurance. This means that they are unable to spread the risk across a larger pool of employees, resulting in higher per-employee costs for health insurance.

As a result, small businesses often find it challenging to provide competitive health insurance benefits that are both comprehensive and affordable.By 2025, the landscape of health insurance is expected to evolve with the introduction of new regulations, advancements in technology, and shifting consumer preferences.

These changes may present both opportunities and challenges for small companies looking to provide affordable health insurance to their employees. It is crucial for small businesses to stay informed about these developments and explore innovative solutions to overcome the obstacles they face in offering affordable health insurance benefits.

Strategies to make health insurance more affordable for small companies

Small companies can adopt innovative approaches to reduce health insurance costs for employees, making it more affordable for both the employer and the employees. Leveraging technology plays a crucial role in creating cost-effective health insurance solutions tailored for small businesses.

Let’s explore different health insurance models designed for small companies in terms of cost and coverage.

Implementing Wellness Programs

One effective strategy for small companies to reduce health insurance costs is by implementing wellness programs. These programs promote healthy behaviors among employees, leading to lower healthcare expenses in the long run. By encouraging preventive care and healthy lifestyle choices, companies can lower insurance premiums and overall healthcare costs.

Offering Telemedicine Services

Another innovative approach is to offer telemedicine services as part of the health insurance package. Telemedicine allows employees to consult with healthcare providers remotely, reducing the need for in-person visits and lowering healthcare expenses. This not only saves time but also cuts down on costs associated with traditional healthcare services.

Exploring Health Reimbursement Arrangements (HRAs)

Health Reimbursement Arrangements (HRAs) are a flexible and cost-effective option for small companies to provide health insurance benefits to employees. With HRAs, employers can set aside funds to reimburse employees for eligible medical expenses, giving them more control over their healthcare costs.

This model allows for customization based on the company’s budget and the needs of the employees.

Comparing Health Insurance Models

| Insurance Model | Cost | Coverage |

|---|---|---|

| Traditional Group Health Insurance | Higher premiums | Comprehensive coverage |

| Health Maintenance Organization (HMO) | Lower premiums | Restricted network but lower out-of-pocket costs |

| High Deductible Health Plan (HDHP) with Health Savings Account (HSA) | Lower premiums | Higher deductibles but tax advantages with HSA |

By comparing different health insurance models, small companies can choose the option that best fits their budget and provides adequate coverage for their employees.

Impact of affordable health insurance on employee retention and recruitment

Affordable health insurance can play a crucial role in employee retention and recruitment for small companies. By offering competitive health benefits, businesses can attract and retain top talent, ultimately leading to a more stable and productive workforce.

Employee Retention Rates

- Affordable health insurance can contribute to higher employee retention rates as it shows that the company values the well-being of its employees.

- Employees are more likely to stay with a company that provides comprehensive health coverage, reducing turnover costs for small businesses.

- Health benefits can also create a sense of loyalty among employees, leading to longer tenures with the company.

Significance in Attracting Top Talent

- Health benefits are a key factor for many job seekers when considering employment opportunities, especially in today’s competitive job market.

- Small companies that offer affordable health insurance can stand out from their competitors and attract top talent looking for comprehensive benefits packages.

- Health benefits can be a deciding factor for candidates choosing between multiple job offers, highlighting the importance of affordable insurance options.

Examples of Successful Small Businesses

- Company XYZ, a small tech startup, saw a significant increase in job applications after introducing affordable health insurance options for its employees.

- ABC Consulting, a small consulting firm, experienced improved employee satisfaction and retention rates after implementing a comprehensive health benefits package.

- DEF Marketing Agency successfully recruited top marketing talent by offering competitive health insurance plans, showcasing the impact of affordable benefits on recruitment efforts.

Government initiatives and policies supporting affordable health insurance for small companies

Government initiatives and policies play a crucial role in ensuring that small companies can provide affordable health insurance to their employees. These programs aim to alleviate the financial burden on small businesses and promote access to quality healthcare coverage.

Current Government Programs

- One of the key initiatives is the Small Business Health Options Program (SHOP), which helps small businesses purchase group health insurance plans for their employees.

- The Affordable Care Act (ACA) also provides subsidies for small businesses to offset the cost of providing health insurance to their employees.

- State-based programs like Medicaid expansion and Children’s Health Insurance Program (CHIP) offer additional options for small businesses to cover their employees.

Potential Impact of New Healthcare Regulations

- New healthcare regulations introduced by the government can have a significant impact on the affordability of health insurance for small businesses.

- Changes in legislation can either increase or decrease the financial burden on small companies, depending on the specific provisions and requirements.

- It is essential for policymakers to consider the needs of small businesses when designing new healthcare regulations to ensure that they can continue to provide affordable health insurance to their employees.

Role of Tax Incentives and Subsidies

- Tax incentives and subsidies play a vital role in promoting access to affordable health insurance for small companies.

- Small companies can benefit from tax credits for providing health insurance to their employees, making it more financially feasible for them to offer coverage.

- Subsidies provided by the government help offset the costs of health insurance premiums, making it more affordable for both small businesses and their employees.

Final Conclusion

In conclusion, the discussion on Affordable Health Insurance for Small Companies in 2025 highlights the importance of employee retention, recruitment strategies, and government initiatives in shaping the realm of health insurance for small businesses.

FAQs

How can small companies overcome the challenges of providing affordable health insurance?

Small companies can explore options like group health insurance plans, health savings accounts, and wellness programs to mitigate costs.

What role does technology play in making health insurance more affordable for small businesses?

Technology enables small companies to streamline administrative tasks, offer telemedicine services, and implement data-driven strategies to reduce healthcare expenses.

How does offering affordable health insurance impact employee retention?

Providing affordable health insurance can enhance employee loyalty, job satisfaction, and overall retention rates within small companies.

Are there government programs that support small companies in offering affordable health insurance?

Yes, initiatives like SHOP (Small Business Health Options Program) and tax incentives aim to assist small businesses in providing cost-effective health insurance options to employees.