How to Get Free or Low-Cost Medicare Advantage Plans sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

As we delve into the intricacies of researching, qualifying, enrolling, and utilizing Medicare Advantage Plans, a world of possibilities unfolds before us.

Researching Medicare Advantage Plans

When considering Medicare Advantage plans, it is crucial to research and compare various options to find the best fit for your healthcare needs. Understanding the different types of plans, coverage details, costs, and network providers can help you make an informed decision.

Different Types of Medicare Advantage Plans

- Health Maintenance Organization (HMO) Plans: Require you to choose a primary care physician and get referrals for specialists.

- Preferred Provider Organization (PPO) Plans: Offer more flexibility in choosing healthcare providers, but may have higher costs.

- Private Fee-for-Service (PFFS) Plans: Allow you to see any Medicare-approved provider who accepts the plan’s payment terms.

- Special Needs Plans (SNPs): Tailored for individuals with specific health conditions or needs.

Tips for Researching and Comparing Plans

- Review the coverage details: Understand what services and treatments are included in each plan.

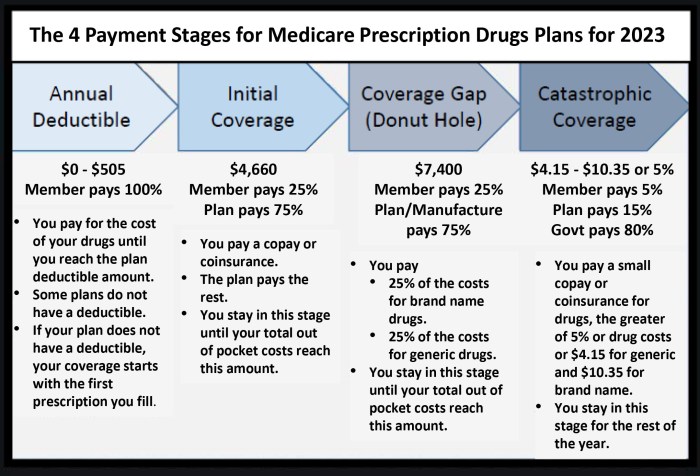

- Compare costs: Consider premiums, deductibles, copayments, and coinsurance to determine the overall expenses.

- Check network providers: Ensure that your preferred doctors, hospitals, and pharmacies are in the plan’s network to avoid additional costs.

- Look into additional benefits: Some plans may offer extras like dental, vision, or prescription drug coverage.

Qualifying for Free or Low-Cost Medicare Advantage Plans

Receiving free or low-cost Medicare Advantage Plans is based on specific eligibility criteria that individuals must meet. Factors such as income limits and other considerations play a crucial role in determining qualification for these plans.

Income Limits for Qualification

- Individuals with limited income, typically below a certain threshold, may qualify for free or low-cost Medicare Advantage Plans.

- Income limits vary depending on the specific program or assistance available in each state.

- Some programs may take into account not only income but also assets and other financial resources to determine eligibility.

Special Programs and Assistance

- There are special programs such as Medicaid that provide additional assistance to individuals with limited income who qualify for Medicare Advantage Plans.

- Extra Help, also known as the Low-Income Subsidy (LIS) program, helps cover prescription drug costs for those with limited income and resources.

- State-specific programs may offer additional support or discounts for premiums, copayments, or other healthcare expenses for eligible individuals.

Enrolling in Free or Low-Cost Medicare Advantage Plans

When it comes to enrolling in free or low-cost Medicare Advantage Plans, it is important to understand the process and follow the necessary steps to ensure you are properly covered.

Step-by-Step Guide to Applying for Free or Low-Cost Plans

- 1. Contact Medicare: Begin by reaching out to Medicare either online, by phone, or in person to inquire about available free or low-cost Medicare Advantage Plans in your area.

- 2. Review Plan Options: Take the time to carefully review the different plans available to determine which one best fits your healthcare needs and budget.

- 3. Apply During the Open Enrollment Period: Make sure to apply for the Medicare Advantage Plan during the designated open enrollment period, typically from October 15th to December 7th each year.

- 4. Submit Your Application: Complete the application for the selected plan and submit it by the deadline to ensure coverage starts when needed.

- 5. Follow Up: Stay in touch with Medicare or the insurance provider to ensure your application is processed correctly and that you receive all necessary information about your coverage.

Important Deadlines and Considerations During the Enrollment Period

- 1. Open Enrollment Period: The open enrollment period is the key time to enroll in or make changes to your Medicare Advantage Plan, so be sure to mark your calendar and submit your application on time.

- 2. Special Enrollment Periods: In certain circumstances, you may qualify for a special enrollment period outside of the regular open enrollment period, such as when you move or lose other coverage.

- 3. Plan Changes: If you are already enrolled in a Medicare Advantage Plan and want to switch to a free or low-cost plan, make sure to review your options carefully and make changes during the appropriate enrollment period.

- 4. Financial Assistance: If you need help paying for premiums or other costs associated with the Medicare Advantage Plan, inquire about available financial assistance programs that may be able to help.

Utilizing Benefits of Medicare Advantage Plans

When it comes to Medicare Advantage Plans, there are a variety of benefits that can help you manage your healthcare needs more effectively. These plans often include coverage for services beyond what Original Medicare offers, such as vision, dental, and prescription drug coverage.

To make the most of these benefits, it’s important to understand what is covered and how to access additional services that may be available to you.

Benefits Covered by Medicare Advantage Plans

- Prescription Drug Coverage: Many Medicare Advantage Plans include prescription drug coverage, which can help you save money on your medications.

- Preventive Care Services: These plans often cover preventive care services like annual check-ups, screenings, and immunizations at little to no cost to you.

- Vision and Dental Coverage: Some plans offer coverage for vision and dental services, including routine exams, glasses, and dental cleanings.

- Telehealth Services: With the rise of telemedicine, many Medicare Advantage Plans now include telehealth services, allowing you to consult with healthcare providers remotely.

Maximizing the Advantages of Medicare Advantage Plans

- Stay In-Network: To maximize your benefits and minimize out-of-pocket costs, make sure to use healthcare providers that are in-network with your plan.

- Take Advantage of Wellness Programs: Many plans offer wellness programs and incentives to help you stay healthy, such as gym memberships or smoking cessation programs.

- Review Your Plan Annually: It’s important to review your plan each year during the Open Enrollment Period to ensure it still meets your healthcare needs and offers the best value.

Accessing Additional Benefits in Medicare Advantage Plans

- Extra Benefits: Some Medicare Advantage Plans may offer additional benefits such as transportation services, meal delivery, or over-the-counter allowances. Make sure to review your plan’s benefits to see what additional services are available to you.

- Special Needs Plans: If you have specific healthcare needs, you may qualify for a Special Needs Plan (SNP) that offers tailored benefits and services to meet your individual requirements.

- Supplemental Benefits: Certain plans may provide supplemental benefits like acupuncture, chiropractic care, or hearing aids. Check your plan documents or speak with a representative to learn more about these offerings.

Conclusive Thoughts

In conclusion, navigating the realm of free or low-cost Medicare Advantage Plans requires careful consideration and informed decision-making. By understanding the process from start to finish, individuals can unlock valuable benefits and secure their healthcare needs for the future.

Popular Questions

What are the different types of Medicare Advantage Plans available?

Medicare Advantage Plans include HMOs, PPOs, PFFS, and SNPs, each with varying coverage and provider networks.

What are the income limits for qualifying for free or low-cost Medicare Advantage Plans?

Income limits vary by state and are based on federal poverty guidelines. Eligibility is determined by income levels and other factors.

How can I apply for free or low-cost Medicare Advantage Plans?

To apply, individuals can enroll during specific enrollment periods or special enrollment periods based on eligibility criteria. Applications can be submitted online, by phone, or through the mail.

What benefits are covered by Medicare Advantage Plans?

Medicare Advantage Plans cover hospitalization, doctor visits, prescription drugs, and additional benefits like dental and vision care.