Embarking on international travel comes with excitement and adventure, but it’s essential to prioritize your health along the way. Private Health Cover for International Travelers offers a safety net, providing access to quality healthcare services when you’re away from home.

Importance of Private Health Cover for International Travelers

When traveling abroad, having private health cover is essential to ensure you have access to quality medical care without worrying about high costs or language barriers.

Benefits of Private Health Cover

- Private health cover offers access to a network of trusted healthcare providers, ensuring you receive timely and reliable medical treatment.

- With private health cover, you can avoid long waiting times that are common in public healthcare systems, allowing you to quickly address any health concerns during your travels.

- Private health cover often includes coverage for emergency medical evacuation, which can be crucial in situations where specialized treatment is needed or in remote locations.

Situations Where Private Health Cover is Vital

- Imagine you fall ill or get injured while traveling in a foreign country. Private health cover can provide access to English-speaking doctors and hospitals, ensuring clear communication and quality care.

- In the event of a medical emergency requiring hospitalization, private health cover can cover the costs of treatment, medications, and even accommodation for your family members if needed.

- If you need to be repatriated to your home country for medical reasons, private health cover can arrange and cover the expenses of your return journey, ensuring you receive care in familiar surroundings.

Types of Private Health Cover Available

When it comes to private health cover for international travelers, there are various options to choose from based on the duration of travel, specific needs, and medical history. Let’s explore the different types of private health cover available.

Short-term vs. Long-term Private Health Cover Plans

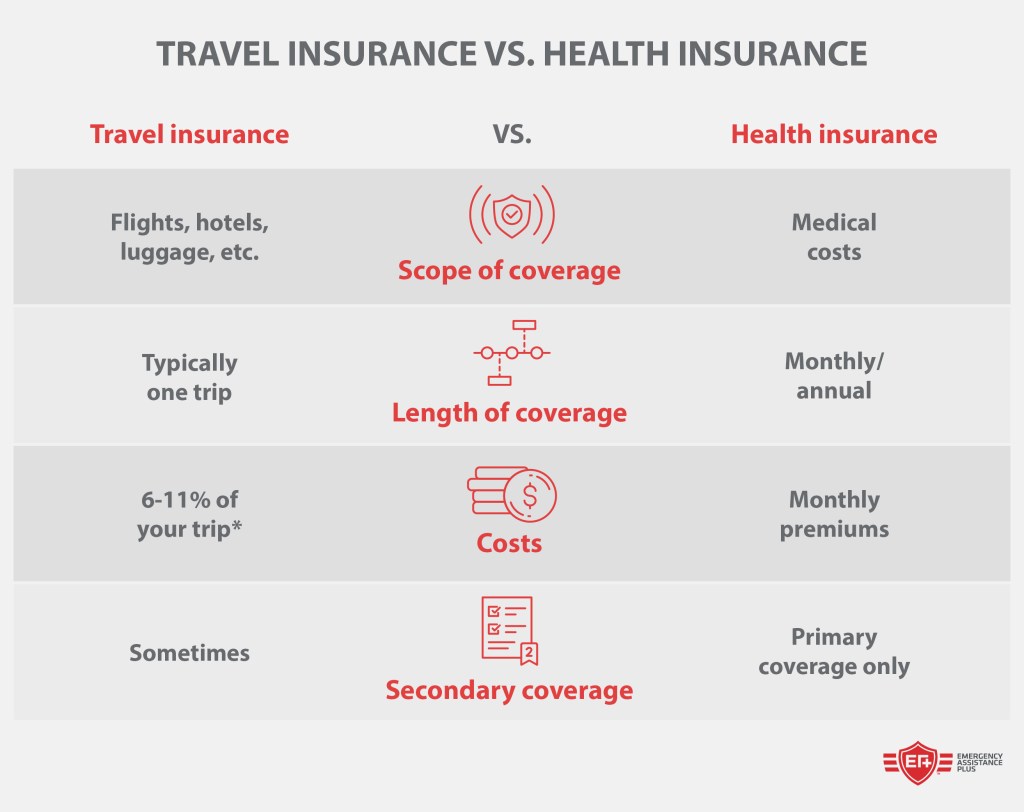

Short-term private health cover plans are designed for travelers who are going abroad for a limited period, usually up to a year. These plans typically offer coverage for emergency medical expenses, hospitalization, and repatriation. On the other hand, long-term private health cover plans are suitable for travelers who plan to stay abroad for an extended period, such as expatriates or digital nomads.

These plans provide comprehensive coverage for both routine and emergency medical services, including preventive care, specialist consultations, and prescription medications.

Specialized Health Cover Plans

For adventure travelers or those with pre-existing conditions, specialized health cover plans are available to cater to specific needs. Adventure travel insurance offers additional coverage for high-risk activities such as mountain climbing, scuba diving, or extreme sports. These plans may also include emergency evacuation in remote locations.

Additionally, travelers with pre-existing medical conditions can opt for specialized health cover plans that provide coverage for their specific conditions, ensuring they receive the necessary medical care while abroad.

Coverage Details

When it comes to private health insurance for international travelers, understanding the coverage details is crucial to ensure you are adequately protected during your trip. Here, we will delve into what is typically covered by private health insurance, common exclusions, and the importance of reading the fine print.

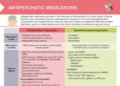

Typical Coverage

- Medical expenses for illness or injury during travel

- Emergency medical evacuation

- Hospital stays and treatment costs

- Prescription medications

- Dental treatment for emergency care

Common Exclusions

- Pre-existing medical conditions

- High-risk activities such as extreme sports

- Mental health conditions

- Pregnancy-related care

- Non-emergency medical treatment

Importance of Reading the Fine Print

It is essential to carefully review your policy to understand coverage limits, deductibles, and claim procedures. Failure to do so could result in unexpected out-of-pocket expenses or denied claims. By familiarizing yourself with the details of your private health cover, you can ensure you are adequately protected in the event of a medical emergency while traveling.

Choosing the Right Private Health Cover

When it comes to selecting the most suitable private health cover for international travel, there are several important factors to consider. By taking the time to evaluate your needs and compare different options, you can ensure that you have the right coverage in place for your trip.

Destination

Consider the destination of your travel. Different countries may have varying healthcare systems and standards, so it’s essential to choose a plan that provides coverage in your specific destination. Make sure the plan includes medical evacuation in case of emergencies.

Duration of Travel

The length of your trip can also impact the type of private health cover you need. If you’re traveling for a short period, a basic plan may be sufficient. For longer trips, consider a comprehensive plan that covers you for an extended period.

Activities Planned

Think about the activities you have planned during your trip. If you’re engaging in high-risk activities such as adventure sports, make sure your private health cover includes coverage for injuries related to these activities. Check if there are any exclusions or limitations for certain activities.

Personal Health Needs

Evaluate your own health needs and any pre-existing conditions you may have. Make sure the private health cover you choose provides coverage for any existing medical conditions and medications you require. Consider any potential health issues that may arise during your trip.

Comparing Options

When comparing different private health cover options, pay attention to coverage limits, deductibles, exclusions, and premiums. Look for a plan that offers a good balance between coverage and cost. Consider reading reviews and testimonials from other travelers to gauge the quality of service provided by the insurance company.

Concluding Remarks

As you plan your next journey abroad, remember that investing in Private Health Cover for International Travelers is not just a precaution but a necessity. With the right coverage, you can explore the world with peace of mind, knowing that your health needs are taken care of.

Questions and Answers

Is private health cover necessary for international travel?

Yes, private health cover is crucial as it ensures access to quality healthcare services in case of emergencies while abroad.

What are common exclusions in private health cover policies for travelers?

Common exclusions may include pre-existing conditions, high-risk activities, and non-emergency treatments.

How can travelers choose the right private health cover?

Travelers should consider factors like destination, duration of travel, planned activities, and personal health needs when selecting the most suitable private health cover.